Barefoot Investor Bank Accounts Explained

The Barefoot Investor recommends you set up your banks accounts in a certain way to help you manage your spending. In this episode I explain the Barefoot Investor bank accounts and buckets and also show you how I set up my bank accounts which is a slight alteration on this strategy.

Today I’m going to be talking about the barefoot investor bank accounts and bucket. We’re going to be looking at how the Barefoot Investor recommends that you set up your bank accounts, which I think is a great way to help you manage your budget and manage your finances.

It can get a bit confusing. He uses some confusing names, so we’re going to look specifically at how he recommends that you set it up, and then I’m going to talk about how I’ve gone about setting it up, which is a little bit different to the Barefoot Investor.

Looking specifically at the chapter on barefoot banking and I know a lot of people got confused as to exactly how to set up these bank accounts. So we’re going to go through each of the accounts so you can really understand it.

Then if you want to go ahead and set this up for yourself, it’s actually really easy to do.

Watch The Video

Buckets

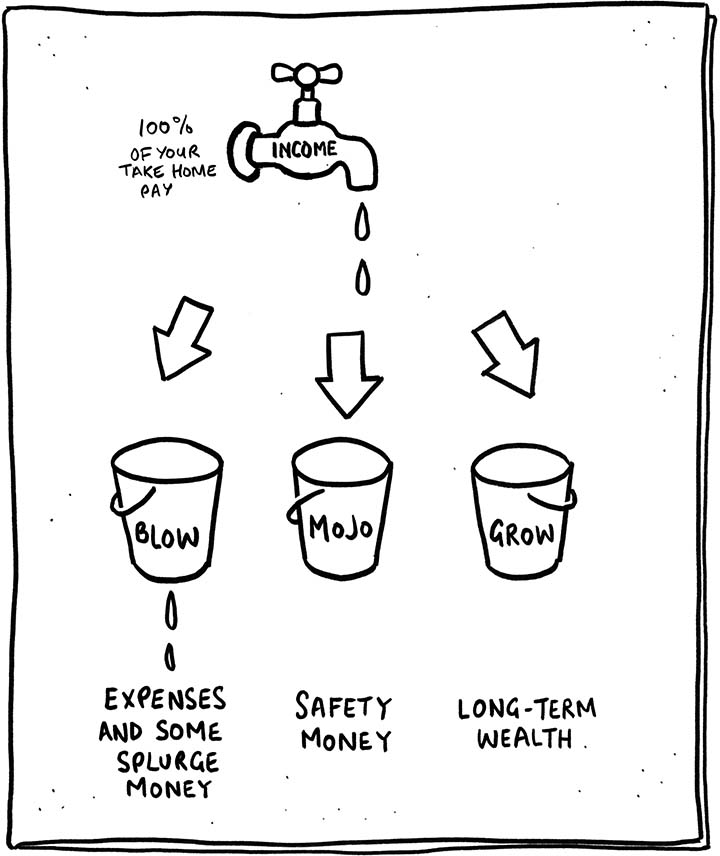

So first we’re going to look at this idea of buckets. He talks about the three different buckets in your life.

First we’re going to talk about the buckets, then we’re going to talk more specifically about the bank accounts.

The barefoot investor talks about these three different financial buckets in your life.

1. Blow Bucket –You’ve got the blow bucket where this is where you spend your money on your life, you’ve got rent, you’ve got living expenses, you’ve got all of that sort of stuff.

2. Mojo Bucket –Mojo is a fancy word for your emergency savings. So instead of having a credit card, you have Mojo

3. Grow Bucket –Then grow is your investments and building your longterm wealth.

So the one that gets most confusing is blow. So we’re going to spend the most time on that, but we will look at Mojo and grow as well.

Blow Bucket

So with blow it’s recommended that you set up 4 bank accounts with ING.

The reason that he recommends ING is because they have zero fees, which is massive. I’ve been charged so many fees by other banks. You can also use any atm as well. And so just overall it’s a pretty good experience with ING.

I personally have followed this advice and set up my accounts with ING and if you want to go ahead and set up through ing, then I think you do get a $25 credit at the moment and then I also get $25 as well if you sign up through my link – click here to sign up with ING.

The barefoot investor recommends that you set up 4 accounts.

You’ve got two accounts that actually have cards attached to them. I tried to set up three because I wanted three, but ING had a max of two. I’m sure I could call them and set up three, but I haven’t been bothered doing that.

Two accounts that have cards attached to them.

1. Everyday Spending

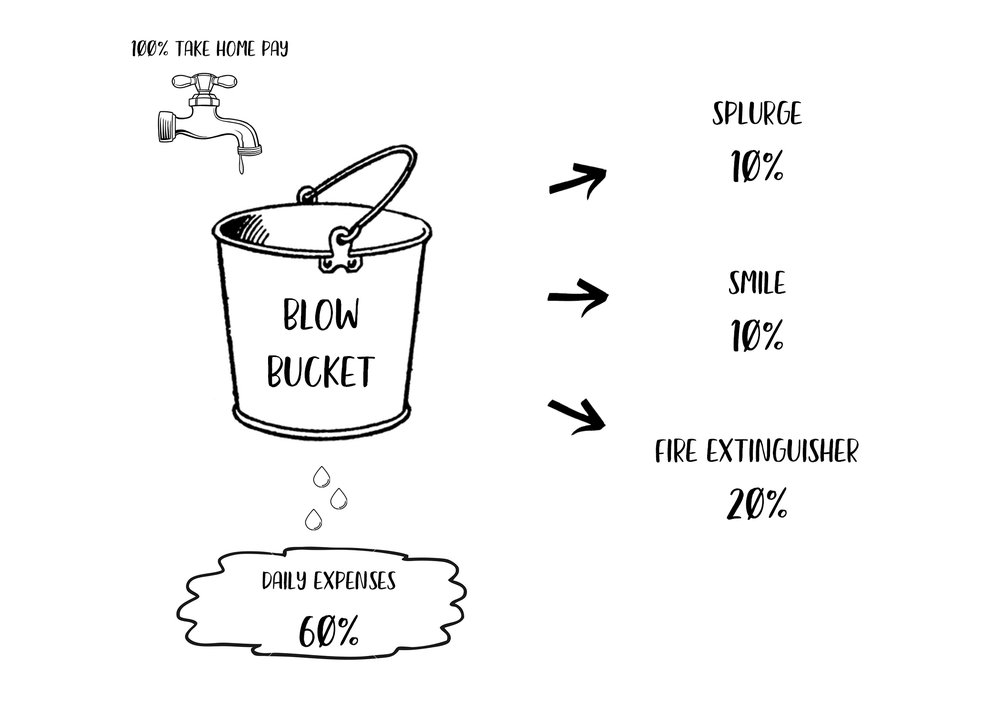

You’ve got your daily expenses which accounts for 60 percent of your income and this is where you’re spending your money on your coffee’s, on your groceries, on all of this sort of stuff.

Barefoot Investor recommends you try and live off 60% of your income through the daily expenses account.

2. Splurge Account

You then have your splurge account, which is 10% of your income. This has to spend on whatever you want.

Basically the splurges in your life. Maybe it’s that extra coffee, maybe it’s some new shoes for the wife like I purchased today.

That’s your splurge account that you can spend on whatever you want.

You then have to online saving accounts with ING.

3. Smile

You’ve got your smile, which is 10% of your income.

This is to save towards bigger purchases that will make you happy.

Holidays, TVS, cars, whatever it may be that your smile account.

4. Fire Extinguisher

And then fire extinguisher is a weird one. It’s a weird name, but it’s also a weird account because you put money into the fire extinguisher and he recommends 20% of your income.

But money doesn’t stay in that account.

Fire extinguisher is to put out the financial fires in your life (it’s a metaphor), and this isn’t necessarily immediate financial fires that you have now, but just fires that are burning and just taking money out of your life.

So this is things like credit card debt, maybe a mortgage debt and things like that

Money goes from daily expenses into your fire extinguisher, but then it basically leaves the fire extinguisher straightaway and goes where it needs to go.

That might be to pay off credit card debt, pay off mortgage debt, or if you’ve paid off all your debt, then the money moves over to Mojo or Grow and we’ll talk about in a minute.

Practically, how does this work?

Basically all your income goes into the daily expenses account. This is where you manage everything.

Your bills also come out of here, your car insurance, your car rego, your rent, your electricity, everything kind of comes out of daily expenses as well as your weekly or monthly living money.

Then you’ve got your separate splurge account, which is just for splurges.

Then you’ve got your online savings accounts.

Now for me, this got quite confusing because the way that I do my budget is that I pay all my regular expenses, phone, internet, rent, electricity, that sort of stuff first, and then me and my wife have a weekly budget that we try and stick to.

So having everything go in and come out of daily expenses just got super confusing having this daily expense account, everything going in and out.

We’re not sure how much money we have left for the week because a new income came in so just got really confusing. So we altered this process.

What We Did Instead

And what we did was instead of having our second card be splurge, we actually made splurge an online savings account. And I’ll show you through all this in a sec.

And then what we did here was we set up a separate daily expenses account and then we had what we’re calling “The Pot”.

The Pot

This is where I manage everything, so all the income comes into the pot, our regular bills go out of the pot and then we have our savings accounts that come off the pot also.

We then also transfer the amount of money that we need each week into our daily expenses account.

Daily Expenses Account

After our regular bills have been paid we transfer money every week into our everyday spending account and then when the money has run out of that account, we know that we’ve reached our budget for that week.

If we go over budget we can then pull from splurge or pull from fire extinguisher if we’ve gone over for the week.

So that’s my alteration of the blow buckets.

Looking At My Online Banking

So going into my online banking, this is my ING account right here.

2 Accounts With Visa Debit Cards

You can see the top two accounts which have cards attached to them.

We’ve got The Pot where everything goes in and regular bills come out.

Then we’ve got our everyday spending which is its own little island. So we send money into that and then each week we spend off that. Then we know when we’ve reached our budget because there’s no money left in that account until more money gets added next week.

The Pot and Everyday Spending each have Visa Debit cards attached to them.

With The Pot we just use the card for NRMA, car insurance, kindy fees and things like that as well as paying bills.

Then Everyday Spending is used to spend our everyday money on.

Multiple Online Savings Accounts

I then set up a few different savings accounts as well.

So we’ve got the splurge account where I put money into each week for splurge purposes.

I don’t do the full 10%, 10%, 20% – I only do what I can afford.

I’ve got my budget that I think we can live off. And then I’ve got certain amounts of money leftover that I can put into splurge that I can put into the smile account, which I call holidays and happiness because my wife got too confused with the smile name.

Then we’ve got the fire hydrant here. So this is the one where money goes in and then it moves to where it needs to move.

Extra Online Savings Accounts

I’ve also set up another online savings account called big bills.

I put money in the big bills account each week and so basically there’s always money in there, so whenever a bill comes in, I’ve got money to pay it.

I just take it out the online savings account, move it back into The Pot and then I pay that bill when I have to do it. So each week I’m moving money into big bills to make sure that I can afford all the bills in my life.

I’ve then got this savings account, which is my Mojo.

Now he recommends that you have Mojo with a different bank, but I just haven’t been bothered to do that yet, but it will go ahead and do that soon.

We’ve talked about blow and we’ve talked about how to set up those bank accounts.

Now let’s go ahead and have a look at Mojo.

Mojo Bucket

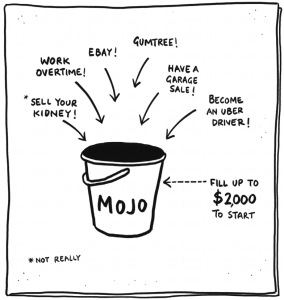

The Mojo account is recommended to be with a separate bank provider. The Barefoot Investor recommends UBank. Again, zero fees.

They have a decent interest rate, but it’s also separated from your regular banking, so you’re not going to pull from it whenever you want to buy that next pair of shoes or clothes or whatever it may be.

Now he recommends that you set up this savings account with UBank and you do whatever you can within your power in order to get $2,000 into that Mojo account.

Now, another great book that I’m reading at the moment is The $1,000 Project by Canna Campbell. So I recommend you go ahead and check out that book if you haven’t already, and that talks about saving up these separate amounts of a thousand dollars outside of your regular income.

If needed, that’ll help you get to $2,000 in your Mojo account, but basically sell whatever you need to sell, do whatever extra work you need to do, get $2,000 into that Mojo account.

The big idea here is that you don’t have a credit card

Your Mojo account is your credit card!

If you have Mojo, if you have money saved up, you don’t need a credit card because you’ve got your own money saved up that you can use when you need to use it.

You then don’t need a credit card, and maybe don’t want one because there’s fees attached to credit cards and Barefoot suggests it’s not really worth it.

Going back to our blow accounts, our fire extinguisher is originally used to pay down debt that we owe.

So we start to pay off our credit card, personal loans and things like that. Barefoot suggests that once our debt is paid off the money that’s going into the fire extinguisher, then goes into your mojo account and builds up this Mojo from the initial starting point of $2,000 to three to six months worth of income.

By building up your savings, it means if you lose your job, if you get hurt or something and can’t work, then you’ve got this three to six months to live off to get you by.

So once you’ve paid off your debt using the fire extinguisher, you then build up your Mojo.

Then once your Mojo is built up then you go ahead and that money goes now into the grow account

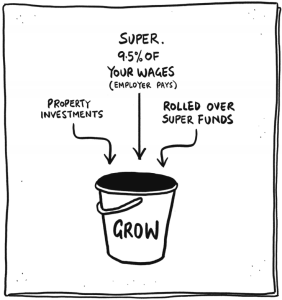

Grow Bucket

The grow bucket is where you’re going to be investing, where you’re going to be growing your wealth.

Money goes from The Pot into your fire extinguisher and then goes out to Mojo until it builds that up and then goes to grow.

Now grow…You can choose to invest in whatever you want to invest in.

- You might just have savings.

- You might put it into shares

- You might put it into property

- You might put it into cryptocurrency.

You can put it into whatever you want to put it into. That is up to you. It’s up to you how you grow and how you build your wealth.

First you pay off debt, then you build up your Mojo, then you invest into growth.

So there you have your Barefoot Investor set up, you’ve got your Blow, Mojo and Grow buckets.

In the Blow Bucket you’ve got your daily expenses, which is 60 percent of your income. You’ve got splurge, which is 10 percent of your income. That’s two different cards and then you’ve got the online savers, smile and fire extinguisher.

Then money goes into the fire extinguisher, pays off debt or financial fires in your life, then builds up Mojo, then builds up grow, so that’s the basics of it.

Mojo is your savings account and starts with $2,000, but you try and build it up to three to six months worth of income and then grow is where you grow your investments, you grow your longterm wealth.

You can do it as he recommends or there’s my alteration as well. That’s where you have The Pot bank account where income and your regular bills go out of.

Then have your daily expenses card where your discretionary money goes and you can spend that.

Then you’ve got online savings accounts for small splurge and fire extinguisher as well. I have that big bills saving account to that I talked about also.

How To Set Up These Bank Accounts

Setting up those bank accounts with ING is really easy. You can go and do it yourself.

It’s free. The bank accounts work great. I’m enjoying it at the moment.

My wife didn’t like that the card was orange. She doesn’t think it’s very sexy, so that’s the biggest downfall with ING haha. Otherwise, everything’s been great so far.

I hope that I explained it well. I hope now that you understand the buckets, you understand the bank accounts and feel empowered to go ahead and sign up.

It’s an online bank, so setting it up was really simple. You basically just go through, say you’re a new customer, and then just fill out details about yourself and then your partner.

If you have one, you set up your first bank account and then once that’s set up and you can log in, then it’s really easy to add that second account and to add those online savers.

I did it all in a couple of hours. The cards came in about a week and then I was able to really set up this process and start using it.

It’s really helped our budgeting, just the fact having that separate account that we put our discretionary money in each week and we know when we’ve gone over budget because the account becomes empty.

It just really helps you be mindful of your budget and helps you be aware.

If you haven’t purchased that book already, definitely worth a read. I found it very, very helpful and insightful. Click here to purchase The Barefoot Investor book.

Other Barefoot Related Content

Barefoot Investor Debt Reduction Explained

Questions About Barefoot Investor

Barefoot Investor’s 9 Steps To Financial Freedom

Resources Mentioned

ING $25 Bonus Offer – Click here to learn more

DISCLAIMER No Legal, Financial & Taxation Advice

The Listener, Reader or Viewer acknowledges and agrees that:

- Any information provided by us is provided as general information and for general information purposes only;

- We have not taken the Listener, Reader or Viewers personal and financial circumstances into account when providing information;

- We must not and have not provided legal, financial or taxation advice to the Listener, Reader or Viewer;

- The information provided must be verified by the Listener, Reader or Viewer prior to the Listener, Reader or Viewer acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener, Reader or Viewers accountant;

- The information may not be suitable or applicable to the Listener, Reader or Viewer's individual circumstances;

- We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, Reader or Viewer, and we have not provided financial services to the Listener, Reader or Viewer.

"This property investment strategy is so simple it actually works"

Want to achieve baseline financial freedom and security through investing in property? Want a low risk, straightforward way to do it? Join more than 20,000 investors who have transformed the way they invest in property."