How To Claim Depreciation On Investment Property

Claiming depreciation on investment property is a great way to minimise your tax and maximise your cash flow returns. However, it is important to claim depreciation on investment property correctly.

Claiming too little means you are missing out on tax saving opportunities but claiming too much or claiming incorrectly could be seen as tax fraud and incur hefty fines. In this post I want to walk you through how to claim depreciation on investment property the smart way.

Firstly, What Is Depreciation

Depreciation (in accountancy terms) is the decrease in value of assets. The technical definition of an asset is basically anything that can be sold for (or converted into) cash.

So just as a car depreciates in value over time so does your house (the building itself) and many of the interiors inside your house (light fittings, carpet etc).

The great thing is that because your rental property is an income producing asset you can claim losses incurred through depreciation at tax time. This can go a long way towards saving you tax and improving your cash flow.

Depreciation is often also referred to as “capital works deductions” by the ATO

What Depreciation Can I Claim On My Investment Property?

There are two types of depreciation you can claim on investment property:

1. Building – Construction costs to the building itself. Items like brickwork or concrete.

2. Plant and Equipment – Item within the building such as carpets, light fitting, blinds or curtains, ovens, dishwashers etc. Believe it or not but garden plants are rarely claimable.

In order to correctly claim depreciation on your property you need to have what is known as “a depreciation schedule” written up. This is the report that states all your claimable depreciation for tax purposes.

It is important to note that in most cases the ATO only allows you to backdate depreciation by 2 years. So try and get a depreciation schedule done as soon as possible.

TIP: You can contest this 2 year limit, but you need a savvy accountant and it is up to the discretion of the ATO commissioner.

How To Correctly Claim Building Depreciation

Claiming building depreciation can be difficult because there are so many varying factors involved.

As depreciation has been introduced in Australia over time properties built during different time periods need to be claimed differently. There is not one set approach for all properties.

Before claiming building depreciation you need to know:

Date construction began

Depreciation percentages are calculated based off when the construction began on the property. Properties constructed in different time periods can claim depreciation differently.

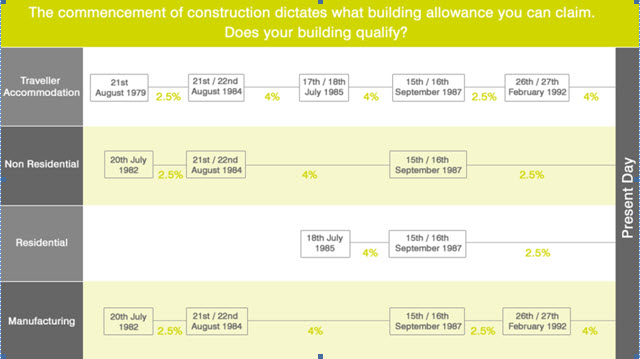

See the below chart to find out at what rate your property can claimed:

PLEASE NOTE: When claiming 2.5% deductions these can only be claimed for 40 years. When claiming 4% deductions these can only be claimed for 25 years

Date construction ended

While rates of depreciation are based off the date construction commenced you cannot begin claiming depreciation until after construction ended. So this is an important date to know.

Cost of construction

This is not the cost to purchase the property or the value of the property. This is the actual cost of construction to build the property at the time of construction.

A quantity surveyor can estimate the cost of construction for taxation purposes if you do not know the cost of the construction

The type of construction

Was it a residential house, residential town house, residential apartment, commercial property etc?

Who carried out the construction work

Was it an owner, was it a builder, was it a developer?

A quantity surveyor can help you identify any information you don’t have or are unsure about. They will then create a depreciation schedule for the building portion of your claim for you. This is the easiest way to do it if you don’t want to calculate it yourself.

Claiming Structural Improvement

You can also depreciate the cost of structural improvements (to residential property) if the construction began after 26th Feb 1992.

Remember, depreciation law has been introduced over time, that is why there are all these differing dates and why it can be so confusing.

How To Correctly Claim Plant and Equipment Depreciation

If you thought building depreciation was confusing wait until you try and work out your plant and equipment depreciation.

First The Good News

The good news is that almost all houses (even really old ones built before 1979) can claim depreciation on plant and equipment.

Many items that you need in your residential property (eg. Blinds, carpets) can be depreciated over time, giving us a tax saving.

Now The Bad News

According to tax law the commissioner makes reviews and determines the effective life of claimable items, and this may change over time.

This means you need to work out which tax ruling, or which schedule accompanying the relevant tax ruling to use for each different item’s effective.

Because an oven might not last as long as the carpet, and the blinds might not last as long as the oven, everything needs to be claimed at its own rate of depreciation.

Back To The Good News – Immediately Claimable Items

There are some items you can claim the full amount on instantly, so you don’t have to depreciate it.

Items under $300 – Let’s say you buy a new microwave for $200 for your tenant. You don’t have to depreciate it over time you can claim the full $200 in the tax year you bought it.

NOTE: Items in a set (eg. Dining chairs) are counted as a single asset. So even though 4 dining chairs might only cost $90 each they will need to be depreciated because the total cost of the set is $360.

Items under $1,000 – Items under $1,000 in value can be added to what is know as the “low-value pool”. This is a collection of items all with values under $1,000.

Anything added to the pool gets depreciated at a diminishing rate of 18.75% in the year that it is added. After the first year an item is added to the pool it is depreciated at a diminishing rate of 37.5% for its effective lifetime.

This saves you having to separately calculate the depreciation of every single little asset you have in the property. It makes calculations much easier.

Everything over $1,000 – Everything over $1,000 needs to have its depreciation calculated based on it’s effective life. A calculation is done (based off its effective life) and the item is generally claimed at a diminishing rate of return.

It is calculated separated until the item falls below $1,000 in value and then it is generally added to the “low-value pool”.

A Scrapping Schedule

If you decide to do a renovation on the property you can get a quantity surveyor to do a scrapping schedule. This allows you to claim the remaining value in the assets you are destroying (eg. ripping out the carpets) and replacing with new asset (eg. new carpet).

Read more on what is a scrapping schedule

A Balancing Adjustment

If you sell or get rid of an asset you were depreciating then often a “balancing adjustment” needs to be done.

This is where you balance how much you have claimed vs what you got for the item.

For example:

You purchased an oven for $3,000 and over the years you have claimed $2,000 in depreciation.

According to the ATO this oven is currently worth $1,000

Let’s say you buy a new oven and sell the old one.

If you sold the old one for $1,500 then you would need to claim the $500 gain ($1,500 – $1,000 remaining value) as income for that year.

If you sold the old one for just $100 then you would be eligible to claim the remaining $900 as a loss

Getting A Depreciation Schedule Done

Ok, so as you can see learning how to claim depreciation on investment property is not an easy feat.

It involves a lot of specific knowledge and a lot of calculations and paperwork. Get it wrong and get audited and you could be charged with tax evasion.

Most investors choose instead to get a depreciation schedule done by an expert quantity surveyor

Depreciation schedules range in cost from an internet report of $200 up to a highly specialised report costing $1,500 or more.

In most cases a depreciation schedule will cost the average investor around $500-$600

There are some companies that offer a guarantee that you will actually save more money from their depreciation schedule than it costs you or you will get your money back.

How A Quantity Surveyor Completes A Depreciation Schedule

A quantity surveyor will visit the property and will find everything that is claimable for you. In some rare circumstances they may be able to create a depreciation schedule from photos of the property, but I am not sure how legitimate this is.

They will estimate the cost of the construction and calculate much much building depreciation you are eligible for.

They will then create a list of all the items in your property that are depreciable assets. They will estimate the value of these assets for you and use their knowledge of depreciation tax law to calculate the correct “effective life” for each individual item over $1,000.

Items under $1,000 they will likely add to the “low-value pool” and calculate depreciation based off those means.

They will then generate and provide you with a professional depreciation schedule which you can check over and take to your tax accountant to help you with your claim.

How Much Depreciation Will I Be Able To Claim?

Depreciation varies from property to property. Generally speaking the newer the property the higher the claimable depreciation will be.

In older properties you may still be able to claim a few thousand dollars in depreciation of your plant and equipment and in newer properties where everything is brand new you could likely gain tens of thousands of dollars in claimable depreciation.

Is Claiming Depreciation Worth It?

Now that you understand depreciation it is important to ask the question “Is claiming depreciation even worth it?”

Let’s me show you some examples and then you can be the judge.

If you are in the 30% tax bracket and can only claim $3,000 in depreciation this will likely save you $900 in tax.

$3,000 x 30% = $900

If you are in the 30% tax bracket and can claim $15,000 in depreciation then this could possibly save you $4,500 in tax

$15,000 x 30% – $4,500

So yes, in most cases claiming depreciation is well worth the effort.

DISCLAIMER No Legal, Financial & Taxation Advice

The Listener, Reader or Viewer acknowledges and agrees that:

- Any information provided by us is provided as general information and for general information purposes only;

- We have not taken the Listener, Reader or Viewers personal and financial circumstances into account when providing information;

- We must not and have not provided legal, financial or taxation advice to the Listener, Reader or Viewer;

- The information provided must be verified by the Listener, Reader or Viewer prior to the Listener, Reader or Viewer acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener, Reader or Viewers accountant;

- The information may not be suitable or applicable to the Listener, Reader or Viewer's individual circumstances;

- We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, Reader or Viewer, and we have not provided financial services to the Listener, Reader or Viewer.

"This property investment strategy is so simple it actually works"

Want to achieve baseline financial freedom and security through investing in property? Want a low risk, straightforward way to do it? Join more than 20,000 investors who have transformed the way they invest in property."